Trends in Online Furniture Shopping (2024)

Online U.S. furniture sales are growing, driven by digital trends and increased comfort with online shopping.

We know a lot about furniture and home decor because we spend hours looking at and learning about how furniture is sold online.

How we see Spoken fitting into the larger landscape of the online furniture market.

Commerce is in a sweeping digital transition

I’ll start by stating what may seem obvious, but is very important framing. Commerce in the U.S. is increasingly online. (Data from the U.S. Census Quarterly Retail E-Commerce Sales.)

So much today happens online. (You know, as you’re reading this online.) You might be surprised to know, then, only 15% of U.S. trade transacts online. 85% of purchases happen offline. Though the internet has been in full swing for 25 years, purchasing online is only just beginning.

Given all the advantages of buying and selling online, and the increasing reach of the internet, this is a trend we don’t expect to reverse. Where does this trend "top out"? No one can say. But it is easy for me to imagine most of my purchases, save groceries and local art, happening online.

One way that this manifests is that you may be comfortable buying things today you never would have thought to buy 10 years ago. Like furniture.

U.S. furniture and decor are following suit

Furniture is a great example of something you might never have purchased online but are willing to consider today. For one thing, shipping big items used to be much harder. For another, the selection online was much poorer.

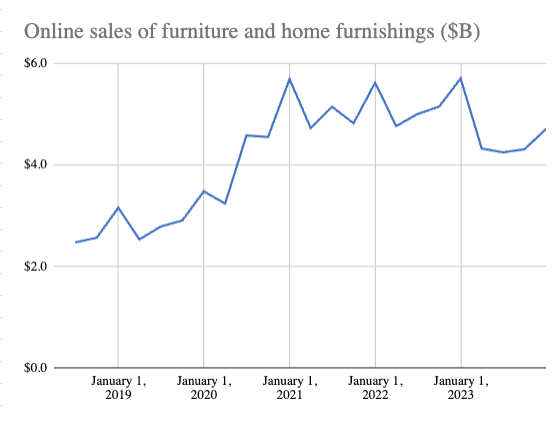

The online shift in commerce has roughly mirrored in furniture (and home decor products). The lockdowns of Covid sent the percentage of online purchases way above trend, as people invested in their home when offline stores were closed. Today the trend is reverting but is roughly on par with the 15% of all commerce, and the trend is up. (Source: U.S. Census data & Spoken estimates.)

The result of (1) furniture sales growing and (2) them shifting online is that online furniture sales are growing increasingly quickly. They’ve roughly doubled in the last 4 years to $4.7B per quarter, growing 13% annually.

Some hurdles exist for shopping online – apprehending the feel of a piece, understanding the true color without light effects, etc.

Yet many of the advantages of buying online are especially important for furniture – a wider selection for individual expression, comprehensive reviews for an expensive purchase, and at-home delivery.

I speak with users every week. All users are more comfortable purchasing online than they were years ago. For the younger generations, they can’t imagine buying furniture anywhere other than online.

Shoppers use their phones for discovery & research

We don't shop "online". We shop on our phones or on our computers.

Since the iPhone's arrival in 2007, an increasing share of online purchases happen on the phone. As of 2024 nearly half (44%) of online commerce happens through mobile, and trending up. (Source: Criteo.)

Why use a mobile phone? The question is really when to use a mobile phone. When it’s convenient. I speak to users who browse on their mobile phone while watching content, riding the bus.

Modern shopping is a blur of activities – offline, desktop, and mobile.

57% of in-store shoppers report using their phone to help them consider their purchase while in a store. Most use their phone to compare prices.

We believe some activities are especially conducive to being done during moments of convenience.

- Discovering new items. Think endless scrolling. The phone was built to scroll. Seeing a lot of things quickly helps inspire your preferences

- Researching products. Once a product has caught your interest, it warrants a deeper dive – reading reviews, reviewing details, etc.

- Comparing prices. Once you know you like an item, you want to make sure your getting the best price.

Discovery & research are broken for furniture & home

Here is where things get interesting. Furniture is a difficult business to succeed in. One of the primary strategies of successful sellers is to actively disrupt product comparison for their products.

One subset of this is white labeling. Though even when sellers don’t actively obfuscate their products through white labeling, they still don’t have the incentives to make their products easy to compare. If they did, you might buy elsewhere.

This breaks discovery, too.

There are relatively few furniture manufacturers and distributors. Yet there are many, many stores. (Setting up an online store is easy.) For all of these sellers, many things differ – their cost-structures, their merchandising, and their willingness to move inventory.

The result is that an online shopper may encounter the exact same item listed at wildly different prices across the internet. "Am I crazy?" No. You're up against an army with a switch blade.

We believe over 80% of existing online furniture products expresses online price discrepancies.

You only need to browse our site to find the examples. Every day, the price discrepancies I find on our own site surprise me. While perusing, I think “this can’t be real”. And then it turns out it is.

This means that, today, product research and comparison are both especially important and structurally impossible in the world of online furniture.

Spoken is building a Map for the Territory

We realized that we could build a kind of map for the confusing furniture territory. The best map would be one without mixed incentives, a neutral map. And so this is the one we built.

The result is a kind of Google-meets-Pinterest for furniture that delivers real-time, actionable information, including pricing and inventory. Furniture is nearly unsearchable on Google or Pinterest, but it will be searchable on Spoken.io — by style, dimension, etc.

In Spoken, we built the tools we wish we had where we wish we had them. We offer price comparison, easy research, and seamless discovery on your phone and on your computer.

Our users crave a simple, authentic experience

What motivates us most about this project? Our users love us. Many users I speak to have simply never encountered anything like us. We are “different” and “a breath of fresh air”. We're "not playing games." We take that to heart.

Users identify our site as “straightforward” and “simple”. We believe all shoppers deserve a simple, digitally-native experience. We hope you find what you love, and we hope to save you some money.

Quick facts

What is ecommerce furniture?

Ecommerce furniture refers to furniture sold through online platforms. Customers can browse, select, and purchase furniture from websites or apps, with delivery options provided by the retailer.

What is the trend of e commerce?

E-commerce continues to grow, with trends focusing on mobile shopping, personalization, faster delivery options, and augmented reality tools for virtual product try-ons. Sustainability is also becoming a significant factor in packaging and logistics.

What is the furniture market situation?

The furniture market is experiencing steady growth, driven by increased demand for home offices and sustainable materials. However, inflation and supply chain disruptions have impacted production costs and delivery times.

What are the trends in ecommerce packaging?

Trends in e-commerce packaging include sustainable materials, minimal waste, and efficient designs to reduce shipping costs. Retailers are moving toward recyclable or biodegradable packaging to meet consumer demand for eco-friendly practices.

What percentage of furniture is sold online?

As of recent data, approximately 15-20% of all furniture sales are made online, with this percentage expected to grow as consumers increasingly rely on e-commerce for convenience and wider product options.

Is furniture sales slowing down?

Furniture sales are fluctuating due to economic factors like inflation and rising interest rates. However, demand for specific categories, such as home office furniture, remains strong.

What demographic buys the most furniture?

Millennials and Gen Xers are currently the largest demographics purchasing furniture, particularly as they invest in homeownership or move into larger living spaces. This group values both affordability and sustainability.

How much can you make selling furniture online?

Earnings from selling furniture online vary greatly, depending on factors like product demand, quality, and platform fees. Some sellers can make a few hundred dollars monthly, while established businesses may generate thousands.

What is the best place to sell furniture online?

Top places to sell furniture online include platforms like Facebook Marketplace, Craigslist, eBay, and Etsy for individual sellers. For businesses, Wayfair and Amazon are popular choices.

What furniture is most profitable?

High-end, customizable, and sustainably sourced furniture is among the most profitable. Products made from solid wood or unique designs also tend to have higher profit margins.

What type of furniture is easiest to flip?

The easiest furniture to flip includes smaller items like chairs, end tables, and dressers. Solid wood pieces that need minimal repairs are often popular choices for flippers.

Who dominates the furniture market?

Companies like IKEA, Ashley Furniture, and Wayfair dominate the global furniture market, leveraging large-scale operations and online platforms to offer a wide variety of products to consumers.

How does Ikea use e-commerce?

IKEA uses e-commerce by offering an extensive online catalog, allowing customers to browse, purchase, and arrange home delivery or pickup. They also incorporate augmented reality tools to help customers visualize furniture in their homes. Spoken can help you compare IKEA's prices with other retailers.

Geoff Abraham

Co-founder & President of Spoken

Geoff is the co-founder and President of Spoken. He is a Dad. He holds a BA from UT Austin (Plan II) and an MBA from Stanford. Geoff has built several successful businesses, including a bicycle taxi business in San Francisco which he ran for 10 years with his wife, Mimosa. He is an executive coach, and he actively invests in seed-stage startups via The Explorer Fund.

Read more